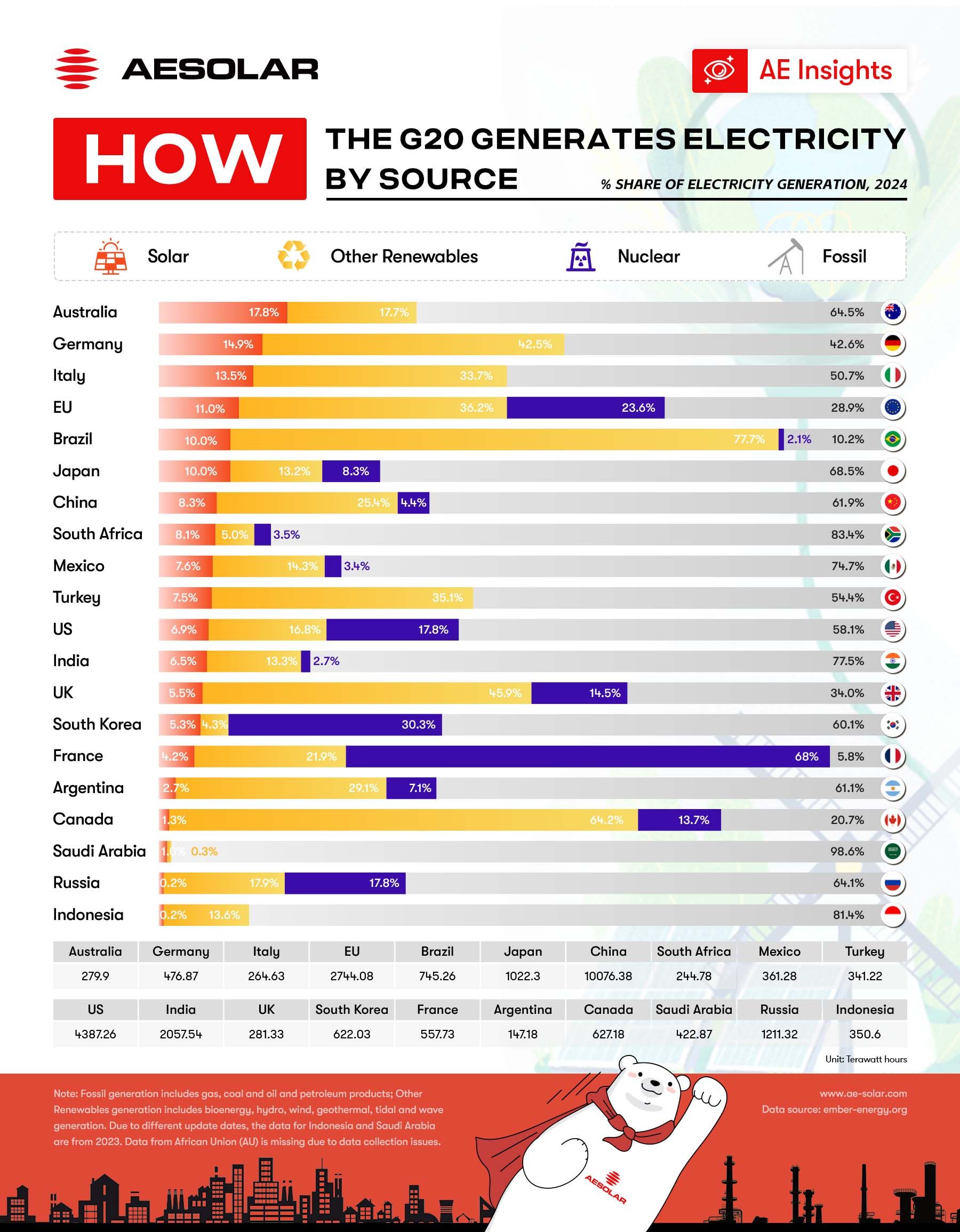

As the global community accelerates efforts to decarbonize, G20 nations—responsible for over 80% of global emissions—face increasing scrutiny over their climate actions. While net-zero pledges by mid-century have become the norm, the pace and scale of renewable energy deployment vary significantly among these countries. Based on the latest data from the International Energy Agency (IEA) and each country’s own targets, a deeper look reveals both progress and pressing gaps.

Europe: Leading, but Not Yet at Full Speed

The European Union, with its collective 2050 net-zero goal, stands out for setting one of the most ambitious renewable targets: aiming for 42.5% of electricity from renewables by 2030, with a stretch goal of 45%. Among member states, France combines this with detailed capacity targets, including 54–60 GW of solar and up to 3.6 GW of offshore wind by 2030.

Germany’s energy transition continues to draw global attention. Having fully phased out nuclear power, the country now relies entirely on renewables and fossil fuels. The data shows strong performance in wind and solar, though the gap left by nuclear still leans on fossil generation. Germany’s Energiewende policy has brought major renewable advancements, but also exposed challenges.

While the EU saw the sharpest increase in clean energy investments in 2023, according to the IEA, most countries will still need to double down on permitting reforms and grid enhancements to meet their goals.

Asia: Huge Potential, Diverse Approaches

In China, the world’s largest emitter and clean energy investor, the scale is staggering. Although its net-zero target extends to 2060—ten years later than most—it accounted for over 50% of global solar and wind capacity additions in 2023. Its short-term target of 33% renewable electricity by 2025 (excluding hydropower, 18%) underscores its rapid pivot.

Yet, coal remains a dominant backup resource, highlighting the need for more energy storage and flexibility. The challenge isn’t lack of renewable ambition—it’s managing a transition at colossal scale. Grid reform, demand-side flexibility, and storage will determine its trajectory.

India’s electricity mix in 2024 highlights the tension between rapid economic growth and the imperative to decarbonize. With over three-quarters of its electricity coming from fossil fuels, India’s grid is among the most emissions-intensive in the G20. India has committed to 50% of its installed power capacity coming from non-fossil sources by 2030. Government auctions, falling solar costs, and grid expansion are all driving this transformation—though coal remains a reliable base-load source for now.

Japan and South Korea, both targeting net zero by 2050, face structural limitations. Japan’s goal of 36–38% RES electricity by 2030 is ambitious given its limited land and public resistance to onshore wind. Korea lags further behind, with only a 20% RES target by 2030. Both countries are investing in offshore wind and hydrogen, but deployment speed remains slow.

Latin America: High Baselines, Room for Innovation

Brazil already has one of the cleanest power mixes among G20 countries, with over 80% of electricity coming from renewables—primarily hydropower. Argentina, with its 2025 target of 20% non-hydro RES generation, has made some progress but faces policy instability and economic constraints. Its 2050 net-zero target, like many in the region, is aspirational but heavily dependent on external financing and technological support.

Africa and the Middle East: Gaining Momentum

South Africa, despite structural reliance on coal, aims for 41% renewable electricity by 2030—a bold ambition amid persistent energy shortages and grid issues. In contrast, Saudi Arabia, a latecomer to the clean energy transition, has set a goal of 130 GW renewable capacity by 2030 as part of its Vision 2030 diversification strategy. While actual deployment has been limited so far, large-scale tenders and international partnerships signal growing momentum.

North America: Bold Targets, Mixed Track Records

The United States and Canada both aim to fully decarbonize electricity generation by 2035—significantly earlier than the 2050 net-zero target. In 2023, the U.S. continued a major surge in renewable capacity additions, driven by incentives from the Inflation Reduction Act. However, challenges in transmission infrastructure and permitting delays remain persistent obstacles.

Canada, with abundant hydro resources, already generates a significant share of electricity from renewables. The target of 90% RES generation by 2030 appears achievable, though the expansion of solar and wind will be critical in provinces relying on fossil fuels.

Oceania: Strong Policy, Fast Progress

Australia's 2024 data confirms its leadership in solar energy. With a 2030 goal of generating 82% of electricity from renewables and plans to double RES capacity every decade, the country is investing heavily in solar, wind, and battery storage. With the highest share of solar electricity among all G20 countries, it is a standout case of how households and rooftop installations can drive national-level change.Despite a historically coal-heavy grid, Australia's rapid solar expansion—largely bottom-up—is reshaping its electricity mix.

What the Data Tells Us

Ember’s 2024 data makes one thing clear: while every G20 country is moving at a different pace, the global direction is unmistakable—toward cleaner, more diversified electricity systems. While 19 of the G20 members have announced net-zero targets, and nearly all have set renewable energy goals for 2030, implementation varies widely. Nations like China, the U.S., and the EU are driving record levels of investment and installation, but even they face significant structural and policy barriers.

At AESOLAR, we believe that solar energy is central to achieving this transition. Since 2003, we've empowered communities and industries with high-quality, German-engineered solar solutions. As this global transformation unfolds, we remain committed to making clean electricity accessible—supporting our partners through every step of their journey.

For enquiries:

📞+49 8231 97 826 80

📧info@ae-solar.com

📩sales@ae-solar.com