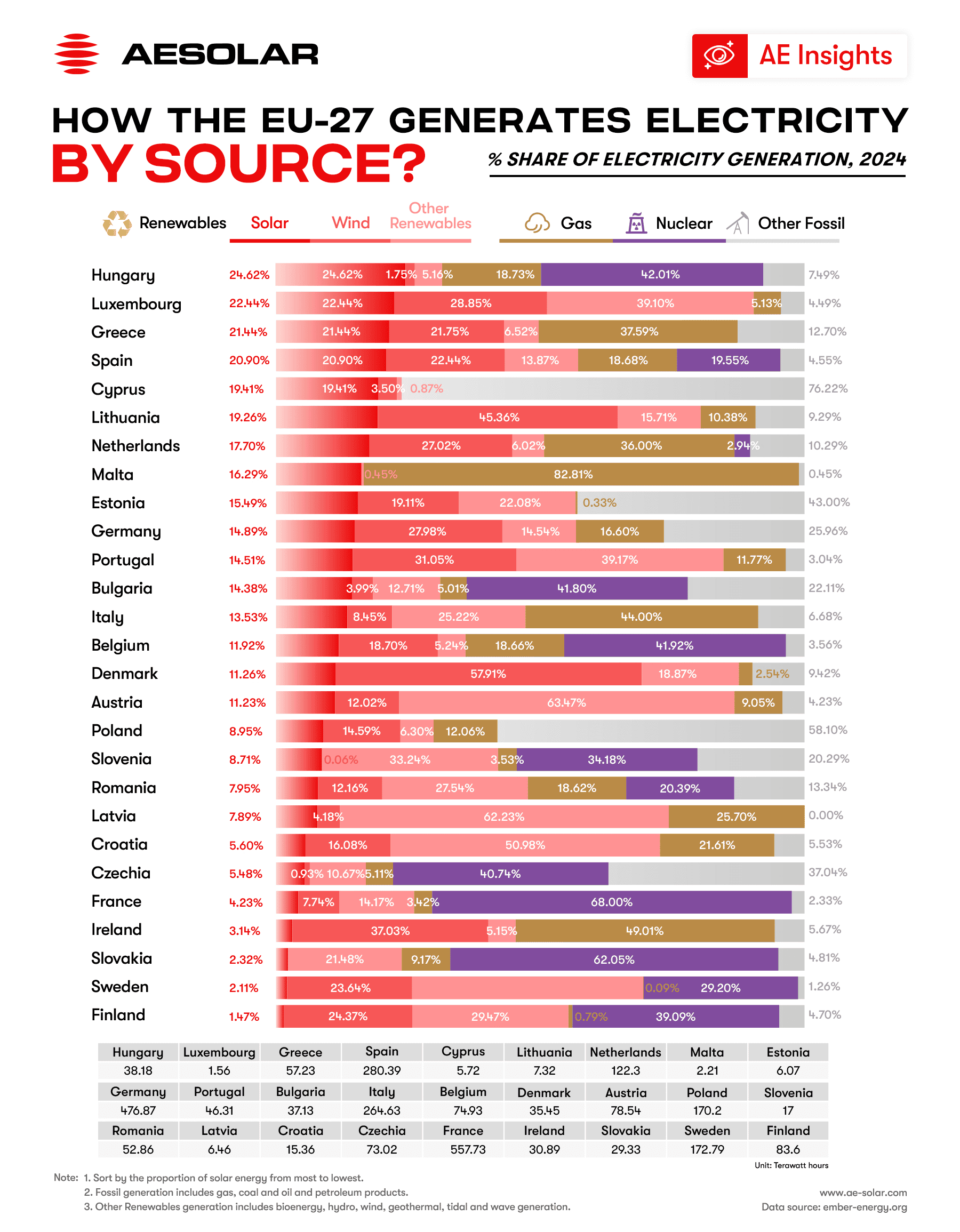

In 2024 the EU achieved a historic milestone: 46.9% of its electricity came from renewables. Wind and hydropower dominated that clean mix (39.1% and 29.9% of renewable output, respectively) while solar PV contributed 22.4%. In absolute terms this meant solar rose to 11.0% of total generation (up from 9.3% in 2023), overtaking coal’s share, and wind held steady at about 17.4% of all power. The result is that coal and gas fell to multi-decade lows: coal dipped below 10% and gas to 15.7% of EU power.

Much of the gain came from capacity expansion. The EU added roughly 16.4 GW of wind and 65.5 GW of solar PV in 2024. Germany alone added 4.0 GW of onshore wind, and along with Spain led EU solar park rollouts. Despite these build-outs, generation growth was uneven: unfavorable wind conditions left wind’s share virtually unchanged, and PV growth slowed to +4.4% in 2024 (after +40–50% annual gains in 2021–2023). Nonetheless, countries with high renewables stand out. For example, Denmark now gets ~56% of its power from wind, and Portugal’s wind/hydro fleet delivers about 87.5% of its electricity.

Spain: Wind (~22%) and solar (~21%) together produced over half of Spain’s power in 2024. This reflects massive build-outs – Spain has become one of Europe’s solar leaders– and brought wholesale prices down (Spanish solar+wind cut prices ~20% in recent years).

Germany: Renewables are also rising fast. Germany added 4.0 GW of wind in 2024, maintaining the EU’s largest wind fleet. Roughly 28% of German power now comes from wind and ~15% from solar (the balance of its 50–60% renewable share). Continued PV deployment and grid upgrades are a key focus of its Energiewende policy.

Portugal: Portugal has one of the highest renewable ratios in the EU: 87.5% of its 2024 generation came from clean sources(mostly wind and hydropower). The country often exports excess solar in summer and leverages its hydro reservoirs for balancing, demonstrating how geographic diversity (sun in the south, rain in the north) can stabilize a renewables-dominated mix.

These record-breaking renewable shares come with systemic challenges. Grid constraints and supply volatility were highlighted by the April 2025 Iberian blackout. Preliminary reports show about 2.2 GW of generation in southern Spain tripped offline seconds before the system collapse. Experts swiftly noted that variable renewables themselves were not at fault – in fact, Spain’s high solar/wind penetration had driven down prices and cut fossil use. The blackout instead exposed rigid infrastructure: the Iberian grid was built for large synchronous plants, and lacked sufficient storage, fast-reacting power electronics and interconnections for sudden changes. The joint report by Beyond Fossil Fuels, ESG, Ember and the Institute for Energy Economics and Financial Analysis warned that Europe’s grid “is failing to keep pace with the renewable power transformation”, underlining the urgent need for more dynamic grids, energy storage and flexibility markets. In short, integrating high shares of wind and solar requires grid modernization – not because green energy is unreliable, but because the grid must adapt to its characteristics.

Looking ahead, distributed, resilient technologies can help overcome these limits. AESOLAR’s product lines are designed for just that. Its Terra Series provides vertical photovoltaic modules (e.g. for building façades or agrivoltaics) that optimize solar capture in space-constrained or non-traditional installations. Its Horizon Series delivers high-efficiency (TOPCon) solar modules certified for carports and rooftops– many of which integrate easily with battery storage. By enabling rooftop and vertical PV deployment, these solutions create localized power sources that relieve transmission stress. In practice, widespread use of vertical PV panels and storage-ready carport arrays helps smooth output and back up the grid at the distribution level. As one analyst noted, “renewables are not the problem; it’s the absence of…storage, advanced electronics, and a regulatory architecture adapted to their nature”– precisely what decentralized PV plus storage offers.

Overall, the 2024 data illustrate both the promise and the pressure of the energy transition. Wind and solar are clearly driving the EU’s clean power surge (leading to unprecedented coal/gas declines), but maintaining reliability now hinges on smarter grids and distributed solutions. AESOLAR’s Terra and Horizon modules exemplify how innovation in PV sector can support that path – unlocking cleaner, more resilient energy even as renewable penetration climbs to new highs.

Data source:

https://ember-energy.org/data/electricity-data-explorer/

https://ec.europa.eu/eurostat/web/interactive-publications/energy-2025