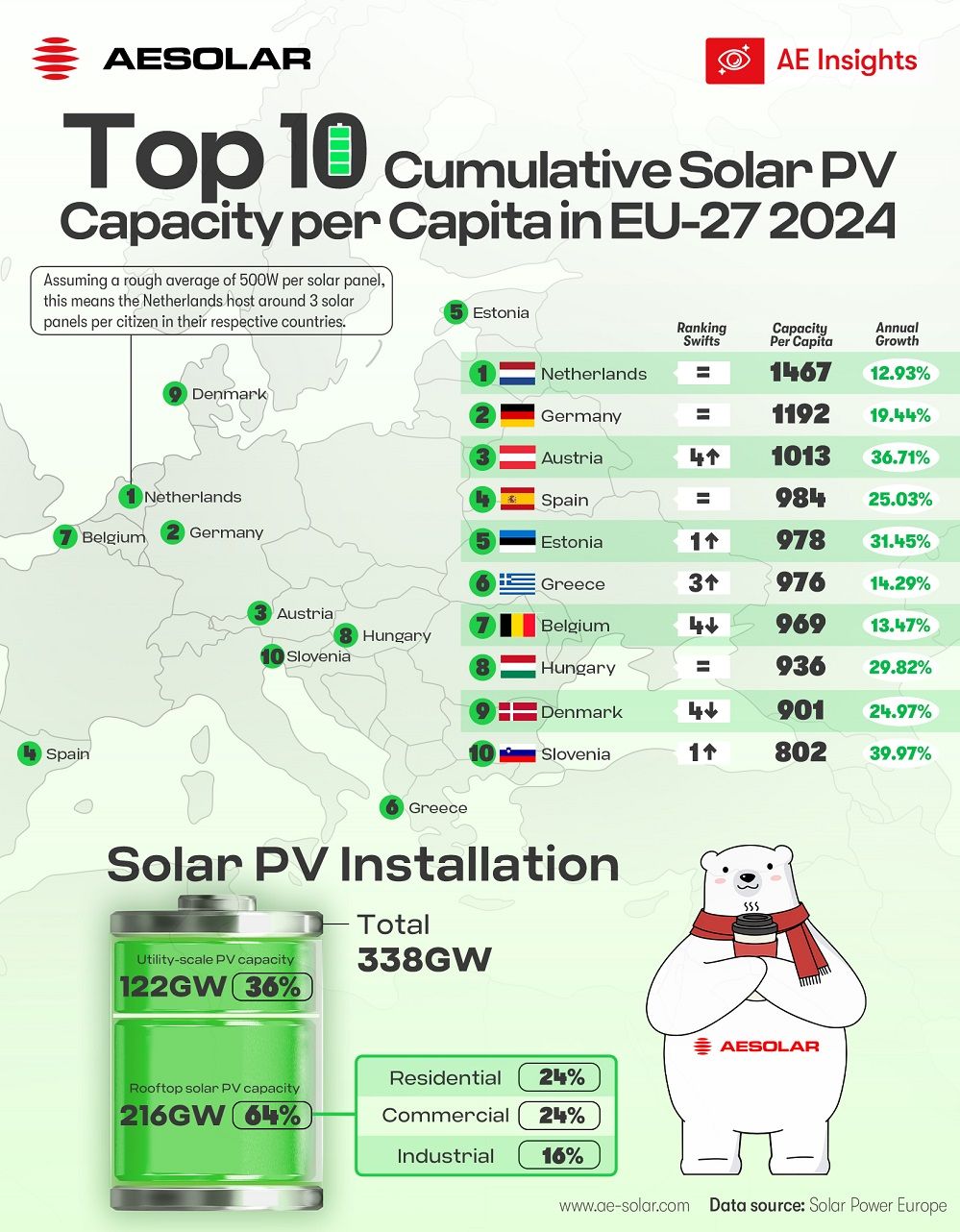

The European solar energy market has seen remarkable advancements, driven by a shared commitment to renewable energy adoption. With an impressive total installed capacity of 338 GW, solar power is rapidly transforming the energy landscape. Rooftop PV systems, accounting for 64% of the total capacity, have become the backbone of distributed energy generation, while utility-scale projects play an essential role in meeting large-scale energy needs.

Leaders in Per Capita Solar Capacity

Europe’s leaders in per capita solar capacity highlight the region's dedication to clean energy:

Netherlands: Leading the continent with 1,467 W per capita, the Netherlands has achieved a milestone equivalent to nearly three solar panels per citizen. This leadership position is supported by a combination of high solar panel adoption rates, innovative net-metering policies, and strong government incentives for rooftop installations. However, recent regulatory uncertainties, including the phase-out of net-metering, have caused a slowdown in residential rooftop installations.

Germany: With 1,192 W per capita and a high 19.44% annual growth rate, Germany’s solar market continues to grow rapidly, fueled by robust government support through its auction programs and feed-in tariffs. Germany’s commitment to achieving its renewable energy targets has led to significant investments in both rooftop and utility-scale projects, with a special emphasis on industrial and commercial installations.

Austria: Growing by an impressive 36.71% annually, Austria reached 1,013 W per capita. Subsidies for residential and commercial installations and strong governmental incentives have propelled its solar adoption.

These nations exemplify how tailored policies can drive growth, even as market conditions evolve.

Rooftop vs. Utility-Scale Markets

Rooftop PV systems dominate Europe's solar landscape, contributing 216 GW, or 64% of the total capacity. The rooftop market is divided into residential (24%), commercial (24%), and industrial (16%) segments. Despite a recent decline in the residential sector due to reduced incentives in several countries, commercial and industrial installations have experienced slight growth, particularly in France and Romania, where policies such as feed-in tariffs and prosumer incentives have driven adoption.

On the other hand, utility-scale solar installations have grown significantly, particularly in Germany, Italy, and Portugal. This segment now represents 36% of Europe’s total installed capacity. However, challenges such as grid congestion and permitting delays hinder faster development.

Market Challenges and Opportunities

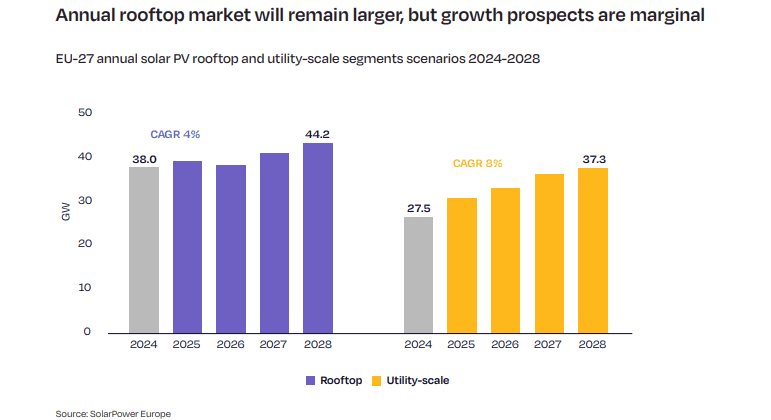

The EU solar market is transitioning from rapid expansion to steady growth, with annual increases expected to range between 3-7% in the coming years. Structural challenges, Policy uncertainty, such as the phase-out of net-metering in the Netherlands and Hungary, and tax changes in Sweden, have impacted residential and rooftop markets, while grid infrastructure limitations and congestion hinder utility-scale projects, remain significant hurdles. Nevertheless, the EU is on track to achieve its REPowerEU target of 400 GW by 2025, according to SolarPower Europe, emphasizing the market's resilience.

As utility-scale projects face grid constraints, rooftop solar will continue to be the backbone of Europe’s solar capacity. Commercial and industrial installations are expected to thrive, supported by policies targeting businesses and prosumers.

As Europe and the Middle East navigate the complexities of the solar energy transition, AESOLAR remains committed to providing innovative and reliable solutions. Our Horizon carport systems and Terra Agri-PV solutions are designed to maximize efficiency and durability, meeting the unique needs of residential, commercial, and agricultural applications. Backed by German engineering and quality standards, AESOLAR’s products are tailored to support Europe’s rooftop revolution and beyond.