Introduction

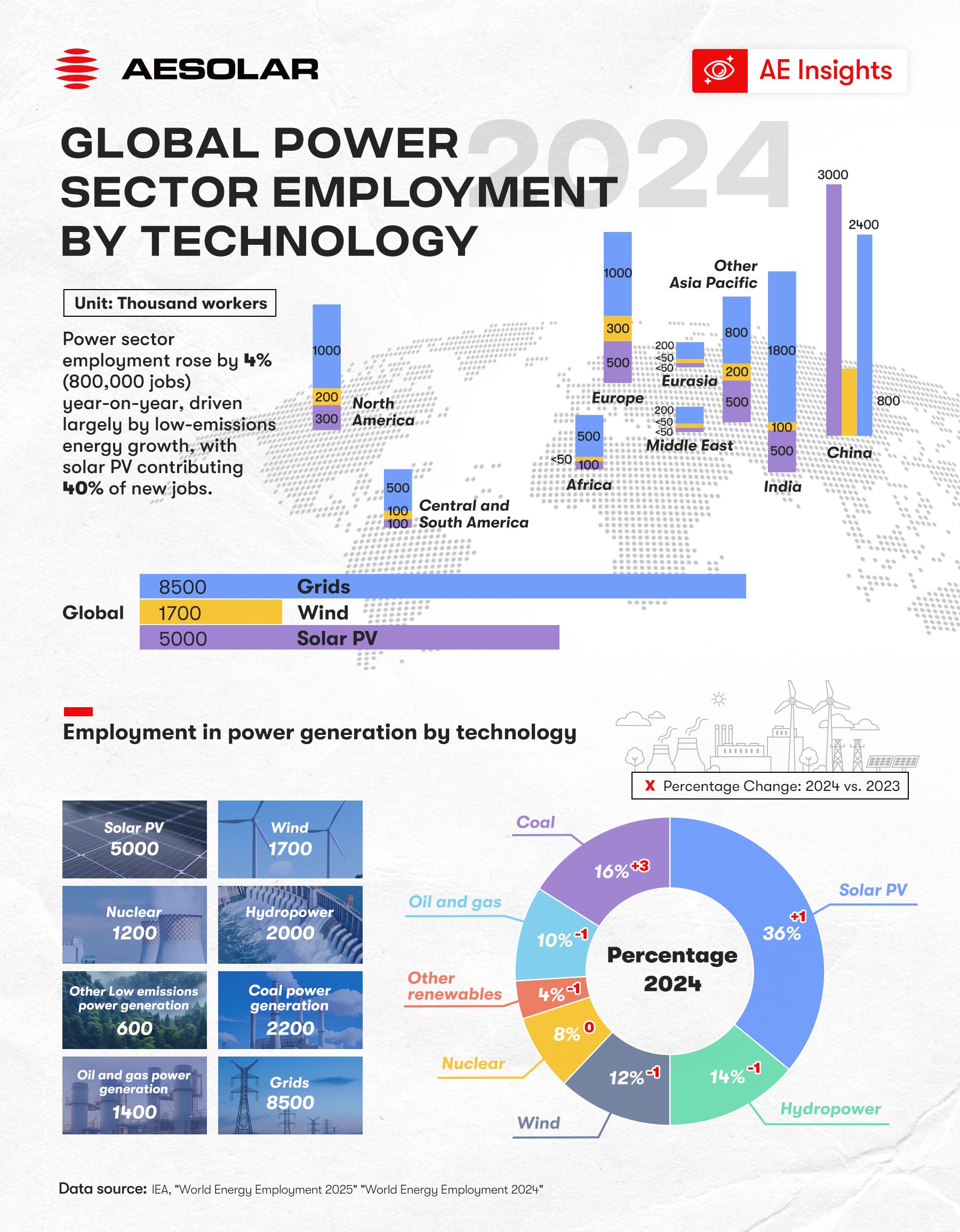

Global power-sector employment continued its strong expansion in 2024, rising by about 4% year-on-year — roughly 800,000 new jobs — driven primarily by investment in low-emissions technologies. Solar PV was the single largest creator of new roles, accounting for roughly 40% of new power-generation jobs and pushing global solar employment to ~5.0 million workers (≈36% of generation employment). At the same time, employment across grids and storage, hydro, wind and nuclear also shaped the labor market, reflecting the complex mix required to decarbonize electricity systems at scale.

Regional breakdown: where solar jobs concentrate

Solar employment remains geographically concentrated but increasingly global in scope. China is by far the largest employer in solar PV with about 3.0 million jobs, reflecting both manufacturing scale and domestic deployment. India accounts for roughly 0.5 million, the Europe solar workforce is near 0.5 million, and North America about 0.3 million. Other Asia-Pacific markets combined contribute approximately 0.5 million, while Central & South America and Africa each show emerging solar employment near 0.1 million. The Middle East and Eurasia currently register lower direct solar employment (<50 thousand each) but exhibit accelerating project activity and grid investments that will likely raise workforce needs. This regional pattern underlines two dynamics: first, manufacturing and large-scale project pipelines concentrate jobs (notably in China); second, deployment and O&M jobs are expanding across diversified markets as distributed and utility PV penetrate commercial, industrial, and public sectors.

Technology-specific insights and dynamics in 2024

The composition of power-generation employment in 2024 reflects the transition underway. Solar PV reached about 36% of generation employment (up 1 percentage point from 2023), while wind accounted for 12% (down 1 point), hydropower 14% (down 1 point), and nuclear 8% (flat). Fossil generation still represents a material share — coal at 16% (up 3 points year-on-year due to some regional project activity), and oil & gas around 10% (down 1 point). Other low-emissions generation sits near 4%.

In absolute terms, the data underpinning the infographic indicate: Solar PV ~5,000k; Wind ~1,700k; Hydropower ~2,000k; Nuclear ~1,200k; Grids (transmission/distribution/storage) ~8,500k. Solar’s contribution to net job creation in 2024 (about 310–320k new roles) was comparable to IEA modelling and survey findings: installation, manufacturing scale-up, and O&M together accounted for most additions. Wind saw slower year-on-year momentum, partly because manufacturing retrenchment in some markets offset new construction jobs.

The centrality of grids

Grid employment — at ~8.5 million workers globally — is the single largest segment in the power workforce and is strategically critical for the renewables expansion. Investment in transmission, distribution and storage underpins the integration of variable renewables: dispatchable balancing, congestion relief, and connection of distributed generation all require skilled lineworkers, system planners, protection engineers, and control-room technicians. In practice, grid development both enables and is enabled by solar deployment: grid projects create jobs in equipment manufacturing and construction while reducing curtailment and improving the value of PV output. Persistent skills shortages for high-voltage electricians, grid engineers and storage specialists were a recurring theme in 2024 reporting and remain an operational risk if not addressed through training and workforce planning.

Labour quality, occupational shifts, and bottlenecks

The changing technology mix is altering the occupational profile of the power sector. Solar employment spans manufacturing operators, installers, structural and electrical trade workers, and digital monitoring specialists. The IEA’s surveys and modelling emphasize acute shortages in applied technical roles — electricians, power-line workers, installers — and an ageing workforce in some grid and nuclear occupations. Upskilling and targeted vocational programs are increasingly necessary: for example, roofers retraining to PV installers, or electrical technicians moving into inverter and storage commissioning roles. Wages and hiring competition have risen as firms seek to secure project timelines, and many companies report proactive internal training and recruitment from adjacent trades as near-term mitigations.

Outlook and implications for niche markets and industry participants

Solar PV’s rapid employment growth in 2024 is both substantive and structural: it signals a maturing, geographically dispersed industry with diverse occupational needs. As deployment broadens beyond utility farms into niche but fast-growing applications — notably solar carports, agrivoltaics, and building-integrated photovoltaics (BIPV) — demand will tilt toward multidisciplinary skill sets that blend construction, civil/structural engineering, architectural integration, and electrical systems engineering. These niche applications often require bespoke mounting, façade-compatible modules, and integrated storage or EV charging interfaces, increasing the need for project engineers, façade specialists, and systems integrators.

Conclusion

For manufacturers and project developers, the implications are clear: product designs that simplify installation, reduce structural complexity, and integrate with storage/EV infrastructure can alleviate labour intensity and support faster deployment. AESOLAR’s portfolio — including carport-optimized Horizon, agrivoltaic-ready Terra, and BIPV offerings — targets these market needs by combining high-yield modules with designs that reduce installation time and structural load. Supporting workforce development through technical training partnerships and clear installation documentation will be essential to convert investment into reliable, scalable job creation.